japan corporate tax rate 2020

Japan Corporate Tax Rate Last Release Dec 31 2021 Actual 3062 Units In Previous 3062 Frequency Yearly Next Release NA Time to Release NA 2010 2013 2016 2021 30 36 42 Japan Corporate Tax Rate. Offices or factories located in up to two prefectures.

Poland Tax Income Taxes In Poland Tax Foundation

Income from 1950001 to 3300000.

. February 7 2020. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. For the latest information and insights on Global Tax rates and what they may mean for your organization please speak with your local KPMG Tax professional.

Income from 9000001 to 18000000. 推薦指數 30 10. Undistributed profits of a foreign subsidiary ie.

Data published Yearly by National Tax Agency. Corporate tax amount is 10 million yen or less per annum and taxable income is 25 million yen or less per annum. The average tax rate among the 223 jurisdictions is 2257 percent.

Japan corporate tax rate 2020. Fines and penalties are not deductible. Tax rates The tax rates applied to profit and loss sharing groups will be the respective tax rates applied to each individual entity in accordance with its corporate classification.

Cfc which is defined as a foreign related corporation frc by the i equity ownership test owned more than 50 by japanese corporations or residents or ii de fact control test to which an applicable tax rate is 30 in case of a shell company or 20 are included in the japanese parent. Historical Data by years Data Period Date Historical Chart by governors Haruhiko Kuroda Masaaki Shirakawa Toshihiko Fukui Masaru Hayami. O A 05 of share capital and capital surplus.

Starting a business in Japan. Japan Income Tax Tables in 2020. Exempted when holding at least 25 for 18 months.

Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. Income from 6950001 to 9000000. Moreover the annual amount of up to JPY8 million in income eligible for the reduced tax rates applicable to SMEs will be distributed.

As part of the corporate tax measures aimed at encouraging business innovation and increasing the international competitiveness of. Revenues from the Corporate Tax Rate are an important source of. 225 rows One hundred of the 223 separate jurisdictions surveyed for the year 2020 have corporate tax rates below 25 percent and 117 have tax rates above 20 and at or below 30 percent.

96 rows Exempted when paid by a company of Japan holding at least 15 direct or indirect or 25 direct shares for six months. The Corporate Tax Rate in Japan stands at 3062 percent. Corporate Tax Rate in Japan averaged 4119 percent from 1993 until 2020.

Income from 3300001 to 6950000. O A 12 of a value-added factor. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

Learn the essentials of Japans corporate tax rates and your obligations as an employer in Japan with Links International. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Based on the maximum rates applied in Tokyo for a corporation which has a paid-in capital of over JPY 100 million is around 30.

National Tax Agency Report 2021 PDF156MB Mutual Agreement Procedures Report 2018 PDF307KB Publication. The ruling parties a coalition comprised of the Liberal Democratic Party and Komeito released an outline of the 2020 tax reforms hereinafter Outline on 12 December 2019. The 2020 Tax Reform Act amended the applicability of this rule by excluding corporations with capital amounts of greater than JPY 10 billion and extended the rules through 31 March 2022.

Corporate Tax Rate in Japan remained unchanged at 3062 in 2021. In Japan the Corporate Income tax rate refers to the highest corporate tax rate for companies with taxable income above 8 million JPY a year based in Tokyo. Japan tax alert 13 February 2020.

5 for holding at least 10 direct or indirect shares for six months. O Progressive tax rate of maximum 36 of the taxable profits. 5 when holding at least 10 for six months.

The maximum rate was 524 and minimum was 3062. What is Corporate Tax Rate in Japan. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

The tax rate information on this page was last updated in January 2021 and the below historical tax rate data is available for reference only. Guidance for Taxpayers on the Mutual Agreement Procedure QA PDF386KB Japans Tax Conventions Including MAP Provisions as of Jan 1 2018 PDF120KB Information for Taxpayers. Recommended for you Tax Future of Tax.

Income from 0 to 1950000. The effective tax rate for companies. Japan corporate tax rate 2020.

2 The rates are reference tax rates on the assumption that the special measures of reduced tax rates for small and medium-sized enterprises will be abolished on March 31 2023. New data on corporate tax rates for the years 2000-2020 was added on JanPDF Japan Highlights 2020 - DeloitteThe effective tax rate for corporations inclusive of the local inhabitants and enterprise taxes based on the maximum rates applicable in Tokyo to a company Worldwide Corporate Tax Guide EYGovernments worldwide continue to. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

Real Estate Related Taxes And Fees In Japan

Real Estate Related Taxes And Fees In Japan

Corporate Tax Reform In The Wake Of The Pandemic Itep

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Corporation Tax Europe 2021 Statista

Global Minimum Tax What Is It How Would It Work For Multinational Companies Bloomberg

日本 企业所得税税率 1993 2021 数据 2022 2024 预测

International Corporate Tax Reform Dgap

Real Estate Related Taxes And Fees In Japan

Australia Tax Income Taxes In Australia Tax Foundation

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

What Would The Tax Rate Be Under A Vat Tax Policy Center

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

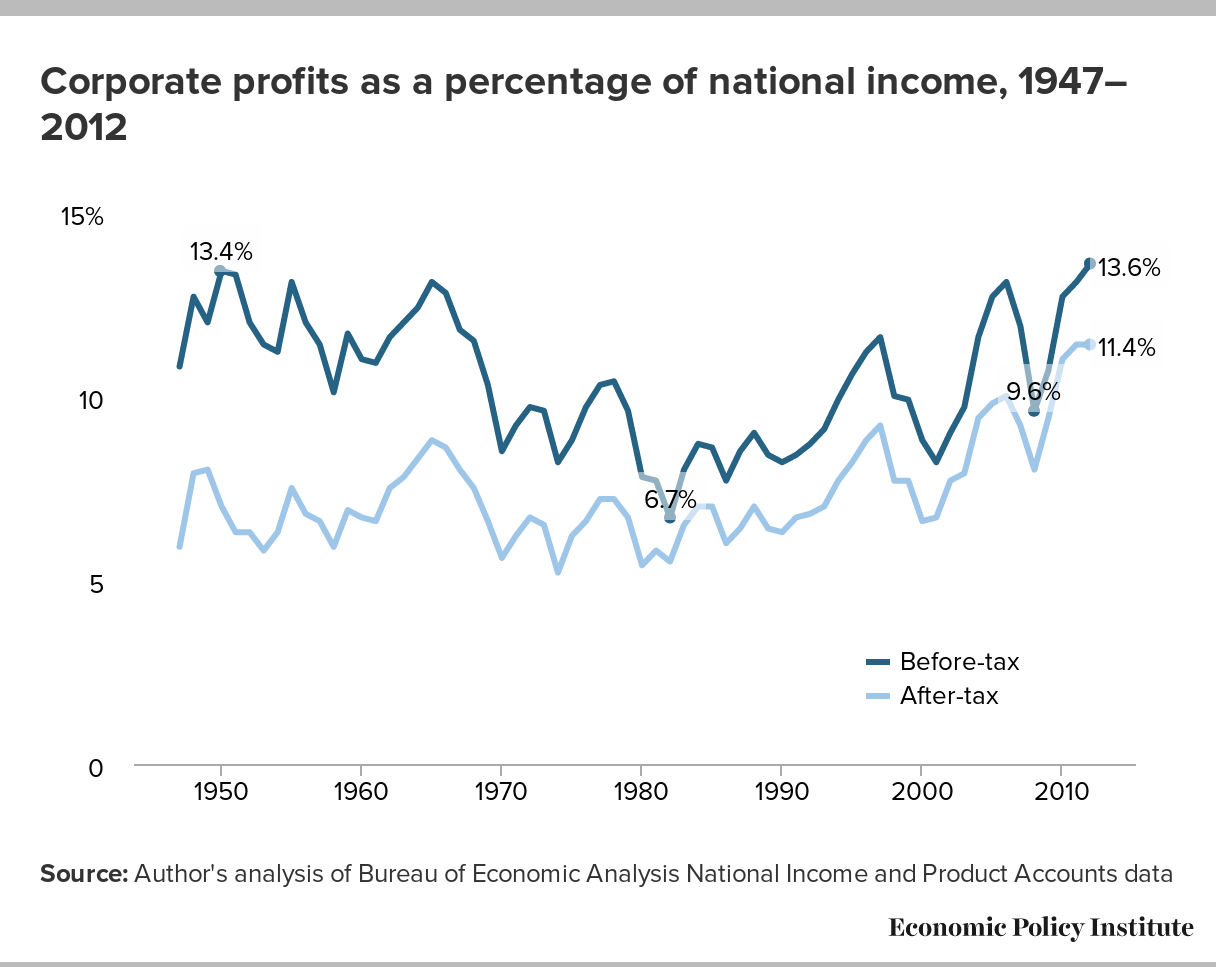

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Doing Business In The United States Federal Tax Issues Pwc

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute